What Does Fortitude Financial Group Do?

Table of ContentsThe Basic Principles Of Fortitude Financial Group Rumored Buzz on Fortitude Financial GroupThe 6-Second Trick For Fortitude Financial GroupGet This Report about Fortitude Financial GroupThe Best Guide To Fortitude Financial Group

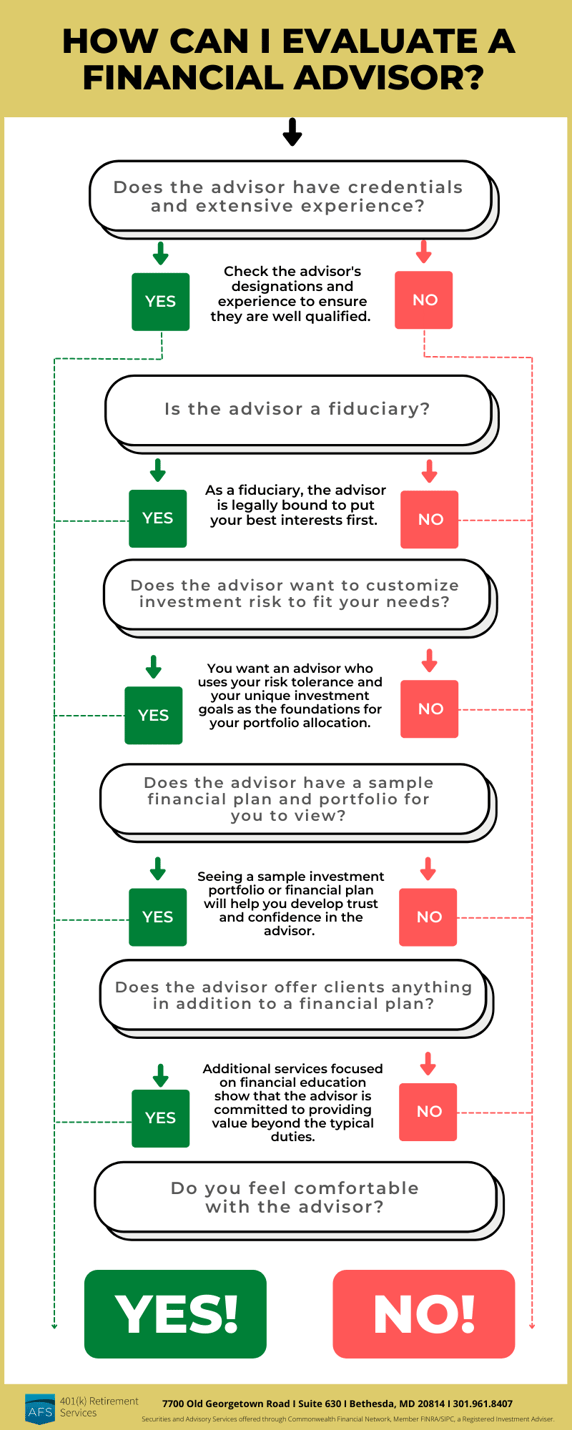

Note that several consultants won't manage your properties unless you satisfy their minimal demands (Financial Resources in St. Petersburg). This number can be as low as $25,000, or get to into the millions for the most special experts. When choosing a monetary expert, discover if the specific follows the fiduciary or suitability requirement. As kept in mind earlier, the SEC holds all consultants signed up with the company to a fiduciary criterion.The broad field of robos spans platforms with access to monetary consultants and financial investment monitoring. If you're comfortable with an all-digital system, Wealthfront is one more robo-advisor option.

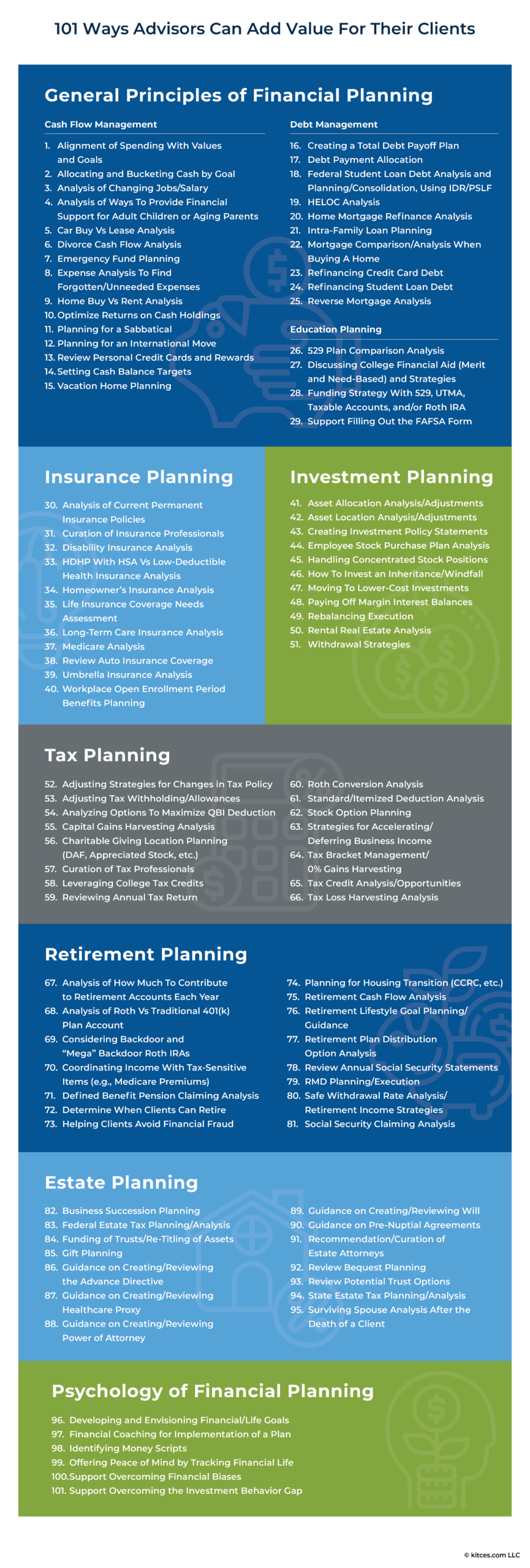

Financial consultants might run their very own company or they may be part of a bigger workplace or bank. Regardless, an expert can aid you with everything from developing a financial plan to spending your cash.

The Only Guide to Fortitude Financial Group

Make certain you ask the best questions of any person you take into consideration working with as a monetary consultant. Check that their certifications and skills match the solutions you desire out of your expert - https://fortitudefg-1.jimdosite.com/. Do you wish to find out more regarding monetary advisors? Look into these articles: SmartAsset adheres to a strenuous and thorough Editorial Policy, that covers principles surrounding precision, dependability, editorial freedom, expertise and objectivity.

Lots of people have some emotional link to their cash or the points they acquire with it. This emotional link can be a primary reason that we might make poor financial choices. A professional monetary advisor takes the feeling out of the equation by providing unbiased advice based on understanding and training.

As you go via life, there are economic decisions you will certainly make that may be made more conveniently with the assistance of a specialist. Whether you are attempting to lower your financial obligation tons or intend to begin intending for some lasting goals, you might gain from the solutions of an economic consultant.

Getting My Fortitude Financial Group To Work

The fundamentals of financial investment administration consist of buying and offering monetary possessions and other financial investments, however it is moreover. Handling your investments entails understanding your brief- and long-lasting objectives and using that information to make thoughtful investing decisions. An economic consultant can offer the information essential to aid you diversify your financial investment portfolio to match your preferred level of risk and fulfill your economic objectives.

Budgeting gives you an overview to just how much money you can invest and how much you must conserve every month. Complying with a budget will certainly aid you reach your brief- and lasting economic objectives. A financial advisor can help you detail the activity steps to take to set up and maintain a budget that benefits you.

Often a medical bill or home repair work can unexpectedly contribute to your financial obligation load. A specialist financial debt management plan assists you repay that financial debt in one of the most economically advantageous method possible. An economic advisor can assist you examine your financial obligation, focus on a financial obligation repayment strategy, supply alternatives for financial debt restructuring, and detail an all natural plan to far better manage financial debt and satisfy your future monetary objectives.

Rumored Buzz on Fortitude Financial Group

Personal capital evaluation can tell you when you can pay for to get a brand-new automobile or just how much cash you can add to your savings each month without running short for required expenditures (Investment Planners in St. Petersburg, Florida). A financial consultant can help you clearly see where you invest your cash and after that use that understanding to help you understand your economic health and just how to enhance it

Threat redirected here monitoring solutions determine possible risks to your home, your car, and your family, and they aid you put the right insurance coverage in location to reduce those risks. An economic consultant can help you create a strategy to protect your earning power and minimize losses when unforeseen things happen.

Fortitude Financial Group Fundamentals Explained

Minimizing your tax obligations leaves more cash to contribute to your financial investments. Investment Planners in St. Petersburg, Florida. A monetary advisor can aid you utilize philanthropic providing and investment strategies to lessen the amount you have to pay in taxes, and they can reveal you exactly how to withdraw your cash in retired life in such a way that additionally decreases your tax worry

Even if you really did not start early, university planning can assist you place your kid via university without encountering all of a sudden huge expenditures. A monetary advisor can lead you in recognizing the very best methods to conserve for future college prices and how to fund possible gaps, describe just how to reduce out-of-pocket college prices, and suggest you on eligibility for economic help and grants.